Emerging Science

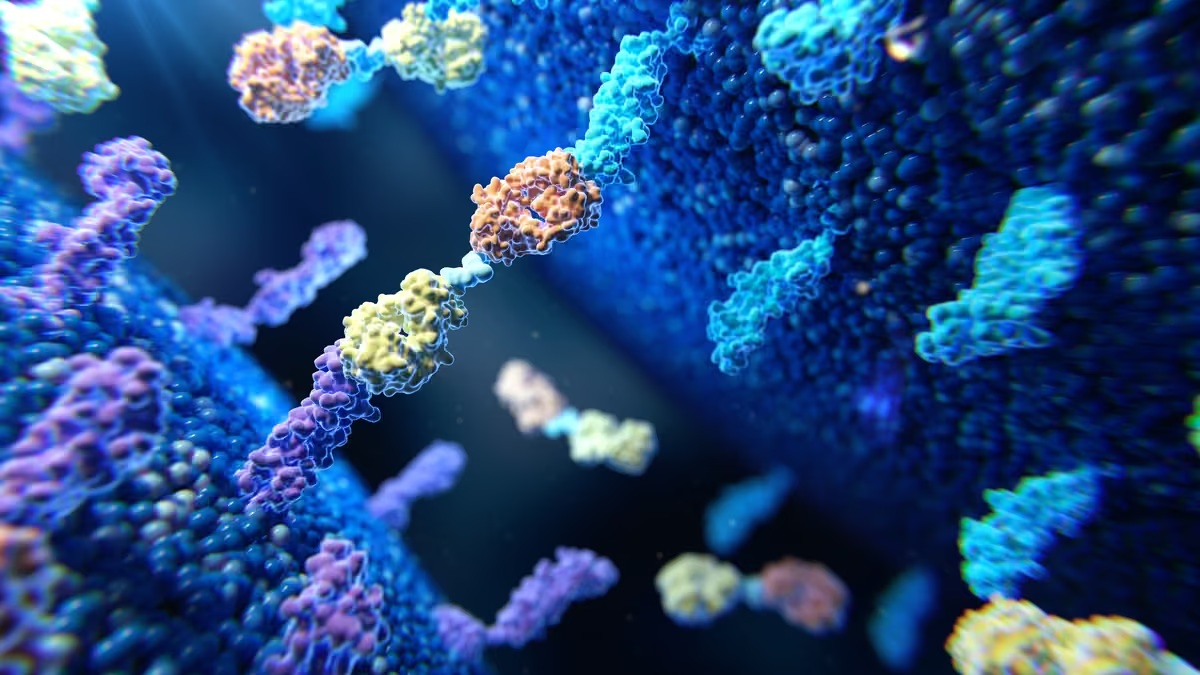

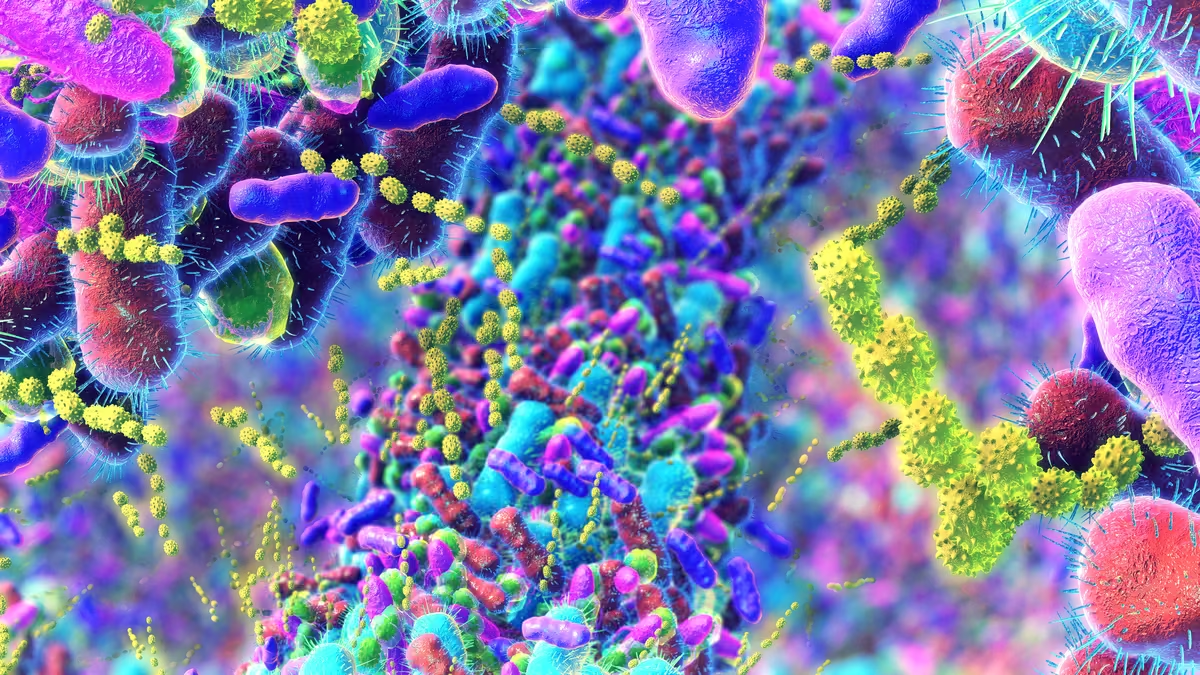

Nipah virus explained: Risks, realities, and the hope from new research

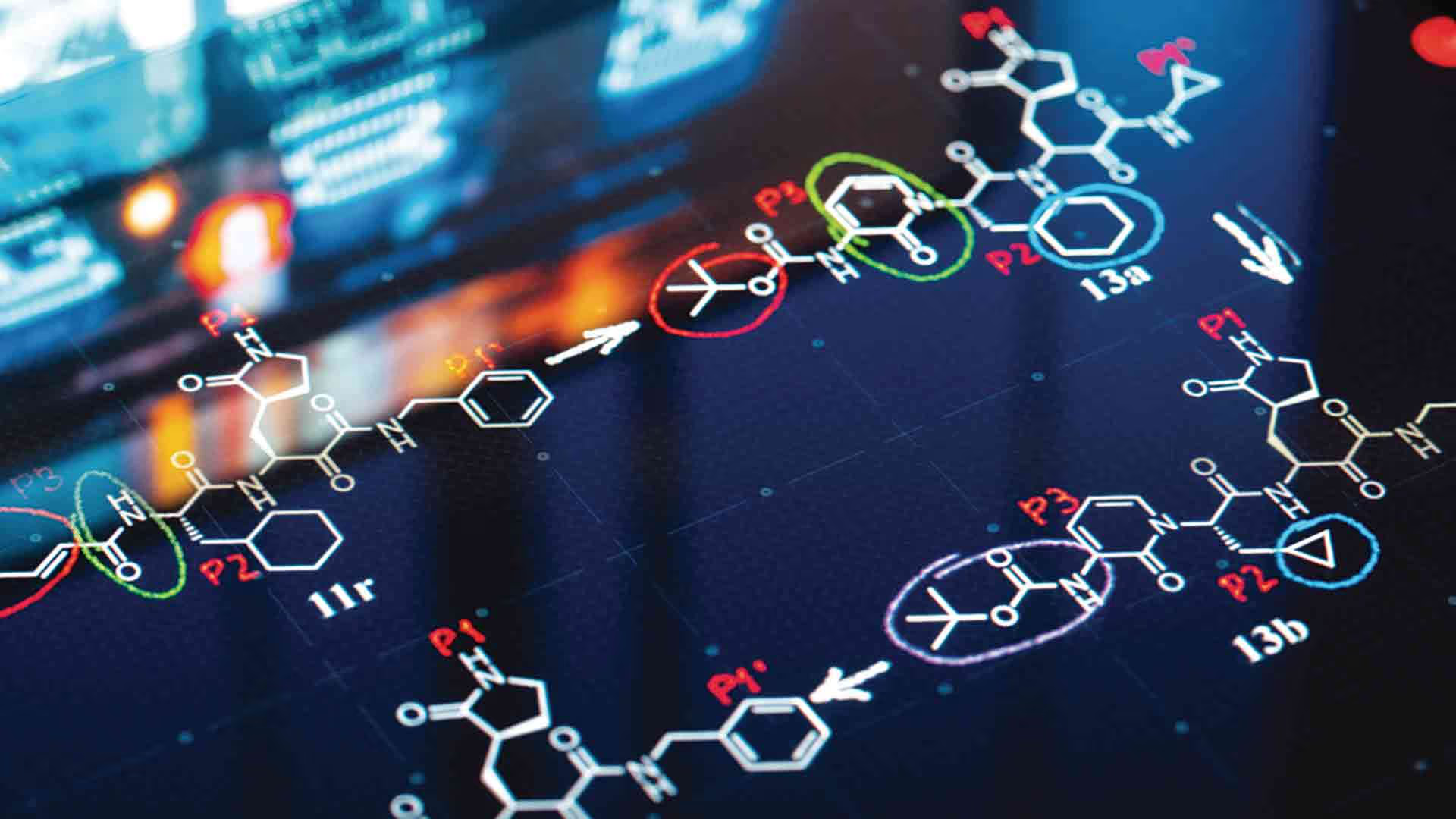

New Nipah cases in India have renewed focus on a high‑fatality zoonotic threat shaped by complex spillover dynamics, severe neurological disease, and limited medical countermeasures. Meanwhile, global efforts in diagonistcs, therapeutics, and vaccines are accelerating.

Leia o relatórioLeia o artigoBaixe o resumoVeja o infográficoLeia a publicaçãoLeia o resumoAssistir ao vídeo